Calculate land value for depreciation

If a company purchases a computer worth 1000 with a projected lifetime of 4 years and you want to depreciate it at a 20 reducing balance you would simply multiply 1000 by 20 which gives you a value of 200. Well use a salvage value of 0 and based on the chart above a useful life of 20 years.

Depletion Method Of Depreciation Accounting Education Economics Lessons Finance Class

After determining the cost companies need to estimate the useful life of the improvement.

. A regulation relating to IRA rollovers stipulating that whenever a financial asset is withdrawn from a retirement account or IRA for the purpose of funding a new IRA for. Tax on Income from Pension and Family pension in India. Here is the calculation for three years.

The 200 or double-declining depreciation simply means that the depreciation rate is double the straight-line depreciation rate used for later property classes. For example the first-year calculation for an asset that costs 15000 with a salvage value of 1000 and a useful life of 10 years would be 15000 minus 1000 divided by 10 years equals 1400. To calculate depreciation we must first identify the acquisition cost salvage value and useful life.

If we apply the equation. The salvage value is estimated at INR 25000. The cumulative total in the last year will equal the Depreciable Asset Value minus the Salvage Value.

Companies need to start by establishing the cost of improvements. A rate of interest of 6 may be adopted to work out the present value of the land. For our playground structure lets say the cost was 21500.

Same Property Rule. Depreciable Asset Value - The depreciable asset value left in a given year during the life of the asset. Calculate the depreciation percentage based on sinking fund method for a building at the age 16 years having life of 50 years at.

Therefore normal depreciation on plant and machinery acquired and put to. In case they cannot calculate its value they cannot capitalize it either. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life.

The 200 percent depreciation rate is calculated the same way as the straight-line method except that the rate is 200 percent of the straight-line rate. The cost of filling of the tank 200 x 3 x 10 Rs. Double declining depreciation 2 x straight-line depreciation rate x value at the start of the year Example.

Accumulated depreciation is known as a contra account because it has a balance that is opposite of the normal balance for that account classification. NADA does not factor in any accessories into the Retail Price. The items found in the data table are the same.

Calculating Depreciation Using the 200 Percent Method. This depreciation method gives you a higher depreciation rate 150 more than the straight-line method. How to Calculate Land vs.

GDS using 150 declining balance. Acquisition price the next step is to identify what portion of that number is attributable to the land. An important rule is that while determining the total basis for depreciation the value of the land is not included as depreciation accounts for assets that wear out over time.

A company acquires a machine for INR 250000 with an expected useful life of 10 years. Once weve established the baseline value ie. 20 Machinery and Equipment.

The purchase price minus accumulated depreciation is your book value of the asset. The formula for this type of depreciation is as follows. As for the residence itself the IRS requires you to calculate depreciation over its 275 useful years using a different method called the modified accelerated cost recovery system.

6000- The price of adjoining solid land 10 years hence Rs. Like any other depreciable asset the accounting treatment for land improvements depreciation is straightforward. In order to calculate the proper amount of depreciation for investment real estate you need to understand the LAND VALUE of the property.

Calculate the 200 percent rate in the same way as the 150 percent method except substitute 20 200 percent instead of 15. The market price of land and the market value of land are not one and the same thing. Where an asset acquired during the previous year is put to use for less than 180 days in that year the amount of deduction allowable as normal depreciation and additional depreciation would be restricted to 50 of amount.

How to deduct depreciation for improvements made. Since its used to reduce the value of the asset accumulated depreciation is a credit. The market price of land is the money that the owner is willing to sell his land for in the open market.

For the next year you would start the depreciation calculation from the original cost minus the depreciation cost. For instance if a buyer is selling a property after 10 years of construction the selling price of the structure can be calculated through following formula-. NADA Retail Value is an arbitrary number that is based off what NADA calculated as the price an RV would have sold for when new.

Take a look at the above 397TH NADA report the MSRP is the same at the top and bottom. 100- per sqm. Add the market value of the land with this price to get.

NADA uses the Retail Price to set the depreciation schedule. Then calculate the depreciation amount using the appropriate IRS rate and method suggested. This chart is essentially an inverse chart of the Cumulative Depreciation chart.

The market value of the land is reflected in how much this land is worth especially in the eyes of prospective buyers as compared to its price. To calculate the depreciation of building component take out the ratio of years of construction and total age of the building.

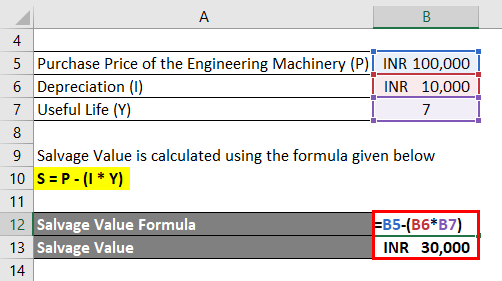

Salvage Value Accounting Formula And Example Calculation Excel Template

Salvage Value Formula Calculator Excel Template

How To Calculate Depreciation Expense

Salvage Value Formula Calculator Excel Template

How To Calculate Land Value For Taxes And Depreciation Accounting Marketing Calendar Template Financial Wellness

Calculating The Land And Building Value Of Your Rental Property

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

Salvage Value Formula Calculator Excel Template

Depreciation Formula Calculate Depreciation Expense

Salvage Value Formula Calculator Excel Template

A Map Of Every Non Disclosure State In The U S And How Real Estate Investors Can Deal With Them Real Estate Investor Real Estate Tips Real Estate Advice

Salvage Value Accounting Formula And Example Calculation Excel Template

Calculating The Land And Building Value Of Your Rental Property

Auto Finance Calculator With Trade Fresh Car Depreciation Calculator Calculate Straightline Car Payment Calculator Car Payment Car Loan Calculator

Example Of A Property With A Good Cash Flow Return Green Label Positive Cash Flow Cash Flow Statement Cash Flow

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

How To Use Rental Property Depreciation To Your Advantage